Data: China lockdown supply chain impact

11 August, Key Takeaways:

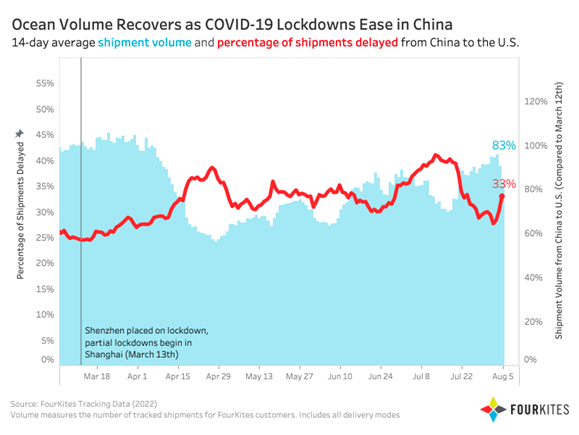

- Delays for shipments from China to the U.S. are starting to tick back up. Delayed shipments along this lane are now at 33% compared to 29% one week ago and highs of 41% seen in mid-July. (Fig. 2)

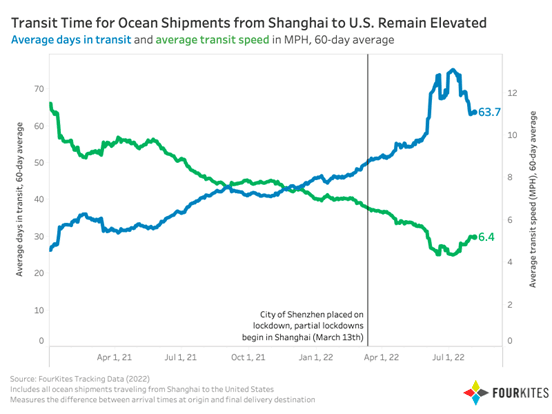

- Yet the number of days shipments are in transit is decreasing. The 60-day average transit time for shipments traveling from Shanghai to the United States is now at 63.7 days after peaking in early July. Since then, transit times are down 15%, but up 27% from 12 March. (Fig. 3)

- According to Ryan Closser, FourKites’ Director of Project Management, Network Collaboration, “The backlog at the ports of Los Angeles and Long Beach are clearing which means there are more chassis available for quicker unloading, likely contributing to the decreased transit time.”

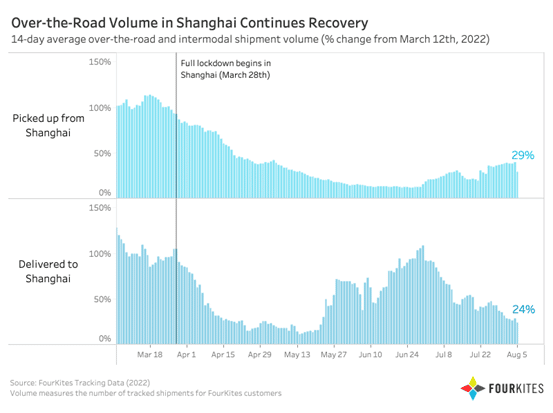

- Over-the-road deliveries to Shanghai have fallen again, potentially contributing to delays. The 14-day average shipment volume for loads being delivered to Shanghai is now down 76% compared to 12 March and has also declined 35% over the past week. (Fig. 5)

Data through August 5, 2022

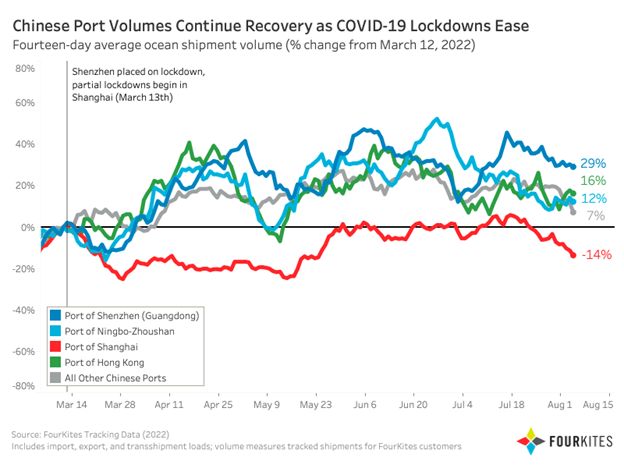

- FourKites has seen recovery in import and export ocean shipment volume at Chinese ports over the past weeks as COVID-19 lockdowns have started to ease. However, as several large Chinese cities have been rolling out more stringent lockdown policies, volume at the Port of Shanghai has started to decrease since the peak in mid-July, down 19% since then. The 14-day average ocean shipment volume is now down 14% compared to 12 March (the day before lockdowns went into effect) and down 9% week-over-week for shipments tracked by FourKites. This is up from mid-May, where shipment volume was down as much as 25% over the same period. For other Chinese ports, volume tracked by FourKites has remained strong, with volume at the Port of Shenzhen up 29% (down 2% week-over-week) and volume at the Port of Ningbo-Zhoushan up 12% (down 1% week-over-week) compared to 12 March.

- FourKites has continued to see recovery in volume travelling from China to the United States. The 14-day average shipment volume for loads travelling from China to the United States is now only down 17% compared to levels seen on 12 March and down 9% compared to last week. Volume along this lane had previously reached a low of 43% lower in mid to late April. Delays remain elevated but starts to dip, with the 14-day average percentage of shipments delayed along this lane now at 33% compared to 29% one week ago and highs of 41% seen in mid-July.

- Average transit times for loads arriving in the United States from Shanghai remain elevated compared to before the lockdowns went into effect. The 60-day average transit time for shipments travelling from Shanghai to the United States is now at 63.7 days after peaking in early July. Since then, transit times are down 15%, but up 27% from 12 March. Currently, transit times are down 1% from last week.

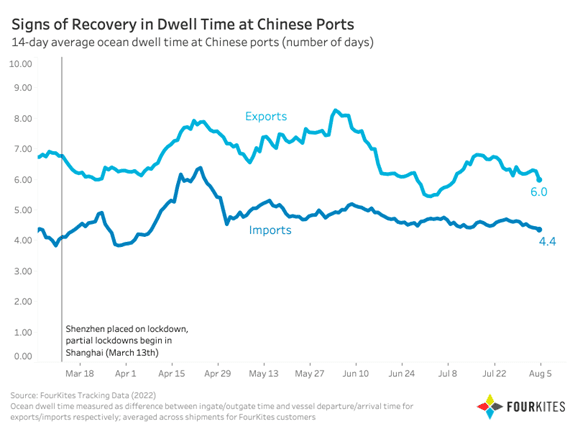

- Dwell times for export shipments for Chinese ports has shown some signs of recovery over the past weeks. The 14-day average ocean dwell time for export shipments tracked by FourKites is now at 6.0 days, which is down 11% compared to 12 March and down 7% week-over-week. This is down 27% from the high seen earlier in June. Import dwell time at Chinese ports remains above levels seen before the lockdown, with the 14-day average ocean dwell time now at 4.4 days. This is an 8% increase compared to 12 March but a decrease of 6% week-over-week.

- FourKites has also continued to see a recovery in over-the-road and rail/intermodal shipment volume in the city of Shanghai. The 14-day average shipment volume for loads being delivered to Shanghai is now down 76% compared to 12 March and has also declined 35% over the past week. However, current over-the-road shipment volumes are still two times higher than the low in mid-May. Volume being picked up from Shanghai is still down 71% compared to 12 March and down 22% week-over-week. However, there has been a 142% increase in shipment volume since the low in mid-June.

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Scott Johnston

European PR Director

scott.johnston@fourkites.com

+31 62 147 8442 |

www.fourkites.com